SMSF HOME LOAN

WITH AN OFFSET ACCOUNT

Boutique Australian Lender. Purchase or refinance. Most lenders do not provide an offset account so this is a great way to save interest costs and access funds.

SMSF lending via an SMSF mortgage or an SMSF loan has increased considerably in recent years. As of June 2013, APRA noted there were 509,362 SMSF funds which was an increase of 7.1% from the previous year. This equates to over $506.0 billion dollars being managed by SMSFs versus $970.1 billion dollars held by APRA-regulated superannuation entities. This means that SMSFs now control about a third of the total superannuation assets in Australia. More information can be found from the APRA website at http://www.apra.gov.au/Super/Publications/Pages/annual-superannuation-publication.aspx

As of 2-Oct-2018, all big four lenders, CBA, ANZ, Westpac and NAB have all pulled out of the SMSF lending space. As a professional mortgage broker providing a full range of home loans, I believe it is the result of the royal commission where there were instances where investors bought poor performing properties and had to take a loss on the the Net Asset Value within their SMSF. This is something the regulators and government do not want. As such, all major lenders have pulled out of the space but will continue to support their existing SMSF mortgage and SMSF loan clients.

Considering that property is one of the largest asset classes held in superannuation funds, it makes sense that more people are looking to purchase property within their SMSF.

Residential – investment properties. Commercial – different types of properties including commercial, retail and light industrial are common to be held within the SMSF. Rural – rural residential investment properties can be held by it is more difficult as lenders are shying away from rural properties in general.

The compliance requirements to purchase property within an SMSF is quite onerous. You need to make sure:

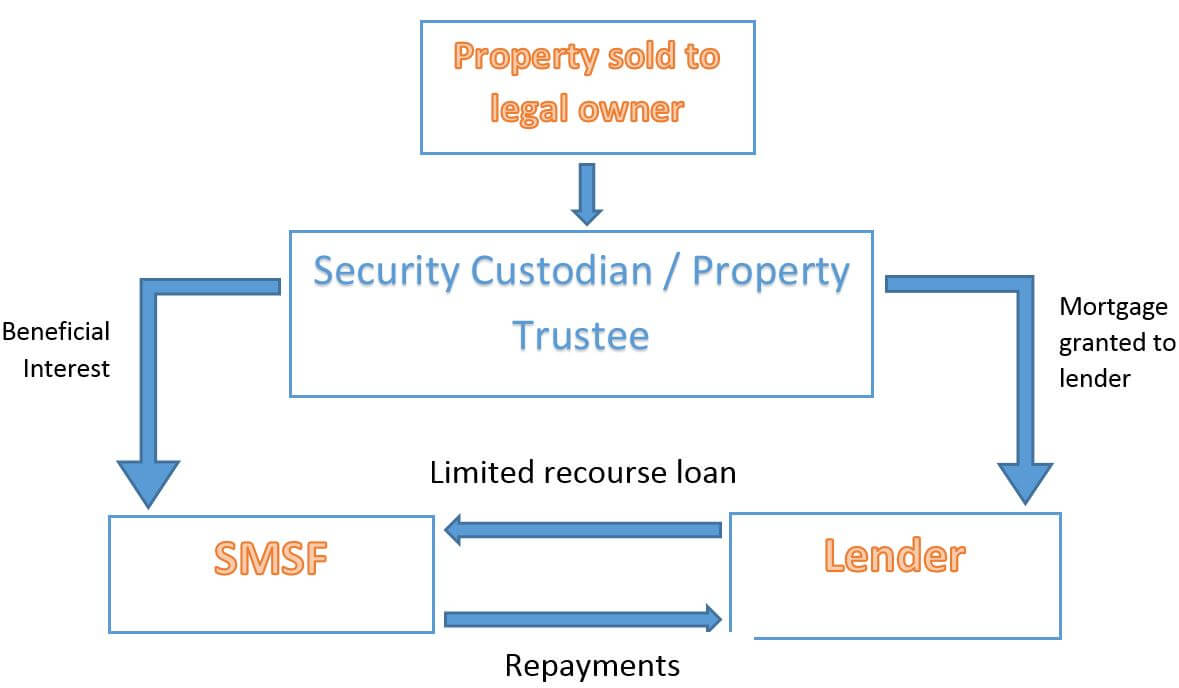

The property is sold to the legal owner which is the security custodian/property trust

The security custodian/property trustee holds the property and grants a mortgage to the lender security by the property

The lender has a limited recourse loan with the SMSF and in return the SMSF pays loan repayments to the lender

Due to the compliance requirements by APRA and the ATO, SMSF mortgage / SMSF loans are different to the more conventional non-SMSF loans. The key (but not limited to) features are:

There is a large difference in the set up costs of purchasing property via an SMSF versus buying property external to an SMSF. Considering most traditional lenders charge a minimal application fee (less than a couple hundred dollars), self managed super fund property loans can have fees up to $5,000 largely due to legal fees in confirming the SMSF trust deed and property custodian/property trust have the correct holding structure and authority to purchase property.

Disclaimer: Still subject to lenders assessment and criteria. This is as good of an estimate we can put online.