How does your credit score work?

The world of credit scoring is more like a black box, even for experts in the finance industry.

There are a few main credit score reporting agencies. Below are the largest three:

Very few people outside of these companies know the algorithm of how your credit score is calculated. We have been told it is a combination of the following:

- The amount of credit applications on your file. All major credit providers now list any application of credit on your credit file. The more applications for credit you have, the lower your score.

- The more recent the application, the more it impacts your score. If you have 3 applications for a credit card on your credit file in the last three months, it is likely to negatively impact you credit score by a lot. If these 3 applications for credit were 2 years ago and there has been nothing since, it is likely your score would only reduce by a little.

- The type of application will impact your score. A mortgage application is considered of better quality than say a personal loan or credit card application.

- Any late or missed payments of existing credit. Since Comprehensive Credit Reporting (CCR) has been accepted by most credit providers, the lenders will put more information about your conduct then they did before. If you miss a payment, it will be logged on your credit file. Also, the amount of time you are late will also be logged, for example if you miss a payment by less than 30 days or more than 30 days. Obviously the longer it takes you to make the payment, the lower your score is.

What is the problem with zero 0 interest credit cards or zero 0 balance transfer cards?

Some people really like the zero 0 interest credit cards and like doing the 0 balance transfer cards from one card to the next. The issue however is it can really affect your credit score and therefore how much you can borrow. Recently I have had several issues which stopped the refinance for 2 different clients.

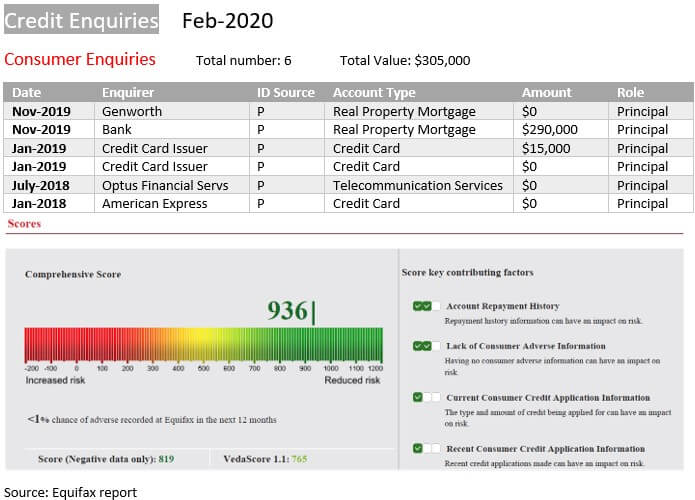

One client is an existing client. 9 months prior, he had a very strong score over 930. Very few people have scores above 900 so this is considered very strong. We submitted a mortgage application because he bought another property and there were no issues with this application.

Everything looking good. Submitted another application to purchase a house and land package.

Fast forward 17 months….

After settlement, he wanted to do some zero balance transfers and submitted 3 applications of credit with 2 different providers. Because there were 3 applications of credit in the last 6 months, with one balance transfer, his score dropped to under 700 which surprised me.

There were no late payments on any of his existing credit, so these applications were the only negative points on his file.

Why is a credit score of 700 important?

The reason that a 700 credit score is an important level to remember is that many lenders who credit score will automatically decline an application if a credit score is under this. So, the few hundred of dollars he saved in credit card interest costs from the zero 0 balance transfer or the low or zero 0 interest credit cards, it will probably cost him easily $1000 in interest he could have saved by refinancing his home loan and using his offset account. All we can do is wait until the credit card applications are not as recent and then his score should go up.

What is the biggest and most common mistake people make regarding their credit file?

They assume that their score is only made up of active or live liabilities/debt and don’t realise it is mainly from the amount of application and their frequency which impacts their score more.

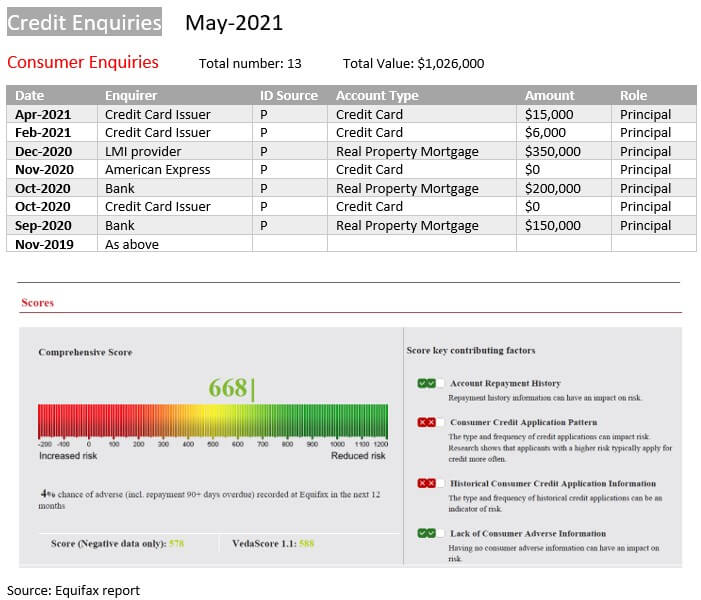

A perfect example of this is a new client wanted to refinance and had:

- 2 home loans

- 3 credit cards

- 1 personal loan

Which is fairly common. The key is she had no missed payment on any old or existing debts.

Her score was 563 because she had 27 applications for credit in the last 3.5 years which is a lot. In one month she had 5 applications for credit cards with 3 issuers. My guess is it will take 12+ months and no more credit applications to get the score above 700.