What is a construction loan?

The first thing to do when looking to build is to make sure you can afford the loan and get a pre-approved construction loan. It is important to know what your budget is from the start otherwise you could waste time and money going down a path you have to start from the beginning again. At Orange Finance we get pre-approval for all our construction loan clients with construction loan lenders who make it easier than the others.

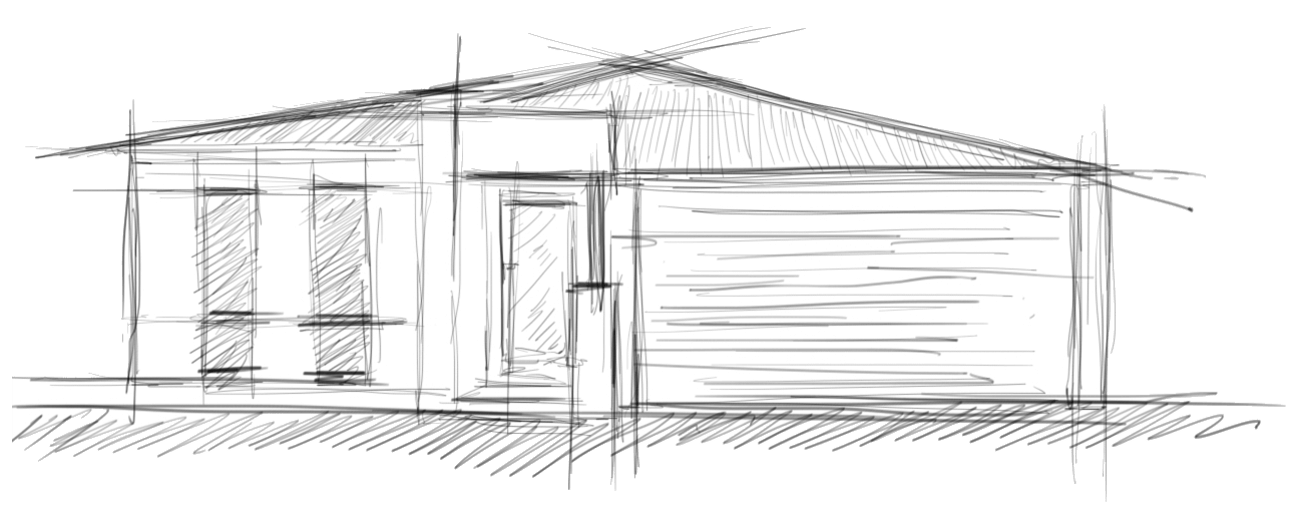

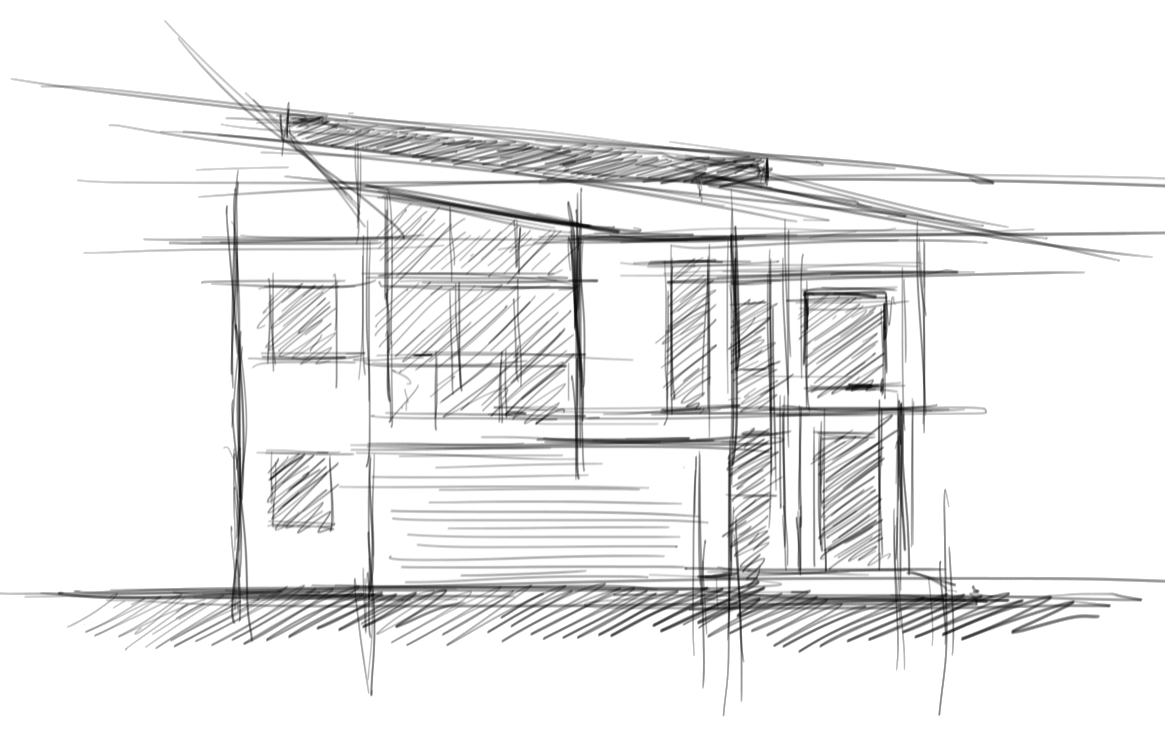

The second thing to do is choose the right builder. Its important to find the builder who is experienced in building the type and style of property you are looking to build. Trying to get a builder who is cheaper but isn’t known to build a particular specification can cause you trouble in the long run because all the subcontractors they typically use also aren’t familiar with the level of specification you might want.

How does a construction loan work?

In a nutshell a Construction or TBE (to-be-erected) Loan is a type of lending option which is supported by a financial institution and provides funding to a borrower and their chosen builder. This can be used on a newly constructed dwelling, undertaking home improvements to an already established home or renovating a property. Other building types may also include:

- Kit homes

- Multiple dwellings

- Transportable homes

- House/land packages

Construction loans have a key feature that they have progressive payments which are paid to the builder throughout the construction phase. These loans are not like your typical home housing loan and not given out in one lump sum – alternatively the payments are paid out in portions and are made at particular stages throughout construction. These are commonly known as draw-downs or progress payments.

Once the loan has been approved and the progression of the build is in the construction phase the lender will make payments to the builder as per the payment scheme. At the end of each stage the builder provides an invoice and the lender releases the loan payment. Once the funds are paid the builder then moves onto the next stage and so on.

Typical example of the progressive payments made to the builder:

| Stage |

Building Stage |

Typical % funds |

| Deposit |

Deposit |

6.5% |

| Stage 1 |

Slab / Foundations |

13.5% |

| Stage 2 |

Frame |

20% |

| Stage 3 |

Walls up |

30% |

| Stage 4 |

Lock up |

20% |

| Stage 5 |

Practical completion |

10% |

|

Total |

100% |

It is important to keep the claim schedule withing lender guidelines

All lenders have guidelines that apply to the builder claim schedule. If you are in the LMI territory or the valuer puts some higher risk weightings, it will nearly always follow the below:

| Progress Payment Stage |

% of Contract |

| Maximum at Foundation Stage (including deposit) |

20 |

| Minimum at Practical Completion Stage |

10 |

| Other individual stages limited to |

≤35 |

| All Stages must total |

100 |

If not, it will not meet lender policy.

Some lenders allow deviation from the above if:

- The LVR is under 80% and

- There are no high risk weightings and

- The valuer has noted the claim schedule is to industry standards.

You need to include either in the builder contract or as external quotes:

- Floor coverings

- Window treatments

- Driveway and crossover

- Painting

- Some landscaping

What is a fixed priced building contract?

This agreement would be the most common of all domestic contracts and relates to where a customer and a licenced builder contractually agree on a fixed price for building a home or endeavour to undertake home renovations prior to initiating the building work. At Orange Finance, all construction contracts that we have seen under $1,000,000 are via a fixed priced building contract. The advantage of having a fixed price contract is that the customer knows of all the upfront costs involved in the project before commencement of any works. This is true for owner occupied and investment constructions.

Majority of fixed price building contracts are completed under a HIA or MBA standard template building contract. Information about the HIA found here https://hia.com.au/. Information about the MBA found here https://www.masterbuilders.com.au/Home.

There are factors to consider with a fixed price building contract with unforeseen changes due to building variations, time delays and outside builder’s costs. Moreover, there are such things as “Provisional sums” which are estimates for items such as site works where costs cannot be determined at the beginning of the build or contract signing.

Fixed price contracts commonly allow for variations to occur during the building phase in which if the customer would like to change or enhance the build in some way they may do so however this is at a cost to the customer. This would typically be the cost of the item including any margin plus GST and administration costs which sometimes quite a substantial amount can be adding to the build amount. Builders will typically put in a minimum charge of $300-$500 to vary the contract so even a small change can cost a lot.

Other factors for the borrower to consider:

- All progress payments are to be paid by the lender directly to the builder

- If a building contract is altered in any way after the loan drawdown has begun with upgrades or changes made then the borrower must ensure they have sufficient funds to pay for these increases.

- If downgrades are made after loan drawdowns has begun then the customer must advise the lender of the variations as this may affect the final valuation of the build/property.

- If council approved plans are altered in any way the bank must be notified

What is a cost plus building contract?

A cost plus contract is where the builder provides a customer with an estimate only of the build and agreed scope of works of which is cost only and a builder’s margin added. The builder gains access to material and labour and is required to provide copies of all invoices for the entire build. This can prove difficult for the customer due to the unforeseen costs involved such as extra labour and increased building material. The same factors as a fixed contract are to be considered with cost plus contracts.

- All progress payments are to be paid by the lender directly to the builder

- If a building contract is altered in any way after the loan drawdown has begun with upgrades or changes made then the borrower must ensure they have sufficient funds to pay for these increases.

- If downgrades are made after loan drawdowns has begun then the customer must advise the lender of the variations as this may affect the final valuation of the build/property.

- If council approved plans are altered in any way the bank must be notified

Typically builds over $1,000,000 have a cost plus as being more common but are still not that common. The reason being, lenders do not like this. There are only a couple lenders who accept a cost plus contract and the restrict lending on this and require proof of additional savings in case there are cost overruns.

Cost plus building contracts also need to a licensed quantity surveyor report submitted in conjunction with the cost estimates to make sure the builder estimates are within range.

Can I do an owner builder loan?

An owner build is anyone who takes responsibility and management of the building or construction of a property. The borrower takes on the tasks and ongoing coordination of the roll which usually is undertaken by a designer or builder regardless of their qualifications.

Note that an owner builder loan is not suited to everyone and it is very different to a fixed or cost plus lend as funding is not available in advance. Funding for an owner build is released at the time of completion once items have being affixed such as when the brickwork has been complete, payment can only is made once this stage has been complete and the bricks affixed in place.

You need to ensure you have the necessary funds to cover where increases or variations may come into play.

A valuation report will be supported and may include:

- Engineer’s details regarding the slab

- Engineers certificate regarding the slab

- Pest treatment confirmation

- Roof details from manufacturer

In all cases lending is considered once it is ascertained that the borrower has enough experience to undertake and manage the construction.

Can I provide additional items outside the building contract?

The licenced builder often incorporates all aspects of the build within the contract however; there are times when a borrower would prefer to provide their own items or special touches to their build. The answer here is it depends on the lender. Some lenders accept items outside of the building contract while some lenders will only pay the builder.

If these items are being funded by the lender the valuer has to consider these items/improvements within the valuation of the property as to arrive at an ‘as if complete’ figure. In turn the bank must always have control of the funds to ensure the work is complete.

These items include:

- Air Conditioning

- Carpets

- Curtains

- Driveways

- Fences

- Flooring

- Landscaping

- Paving

- Pergolas

- Security System

- Swimming Pool

- Window furnishings

Which lenders do construction loans?

Most lenders do have specific construction loans however some smaller lenders have pulled out of this space because of the additional administrative teams they required. Not all lenders make construction loans easy and at Orange Finance we would only recommend the lenders who make the construction loan and payments relatively seamless.

Most construction loans are based on variable loans however there are a few lenders who to allow construction loans to be on fixed rate products. When fixed rate loans are lower than the variable rates, this might be a good way to save some interest costs.