How does an offset account work?

Using offset account properly are a really good way to reduce interest costs on your home loan. By having lower interest costs, you can use the extra money to pay off your home loan quicker. So how does an offset account work?

An offset account primary a bank account and is usually like a “normal” banking transactional account you can use for your day to day banking. The bank will link this account to your home loan in their systems to tell them it is an offset account. As home loan broker experts, we often get asked what the difference is between an offset account and a normal transactional account?

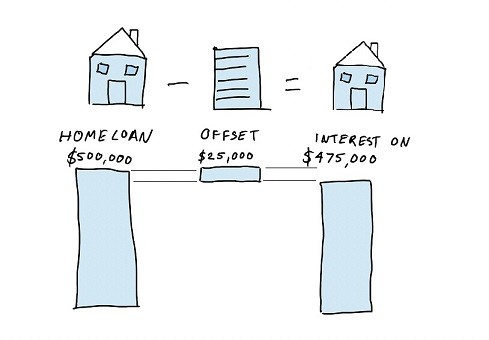

Because the bank links the offset account to the variable rate home loan, the amount of interest the bank will charge you on the home loan is the difference between your home loan balance and the amount of money you have in your offset account. For example, in the (awesome drawing) picture here, assume you have $500,000 loan and you have $25,000 in your offset account. When the bank calculates how much interest they will charge you, they subtract the offset account balance of $25,000 from your loan balance of $500,000 to get $475,000. You might not think this much, but over the life of the loan, if you had $25,000 in your offset account on a $500,000, you would save nearly 3 years off the life of the loan and about $115,500 in interest costs (assuming 6.15% interest rate, 30 yr term). And this number gets bigger when interest rates are higher.

Your repayments might not change

If you have principle and interest repayments, your repayments won’t change if you have savings in the offset account or not.

A lot of people get this wrong because in the “old days” it would change. Nowadays, your repayments don’t change but the allocation of the interest cost savings will be allocated to the principle thereby paying down the loan quicker and reducing the loan term.

Lets assume a $500,000 mortgage at 6.15% P&I 30 year term will have repayments of $3,047 per month.

Lets assume you have no savings in the offset account. The bank will take $3,047 as repayment for the month. In the first year, you only pay down about $630 in principle and the rest $2,417 is interest.

Lets assume you have saved $25,000 which sits in the offset account. The bank will still take $3,047 repayment for the month. The $25,000 in the offset will save you about $128 in interest costs for the month. In the first year, like for like as above, you will then pay down $630 plus $128 in principle = $758 and then the interest cost is only $2289. It might not seem like much but in the above, over the 30 years, this would save you about 3 year on the loan at $115,500 in interest costs.

Hence, your repayments don’t change but the loan term does as the interest saving pays down the loan balance quicker.

If your loan is on interest only e.g. if you have an investment loan, then yes, any savings in the offset will reduce your repayments.

Do your own calculation with our Home Loan Offset Calculator here

What do I need to watch out for?

There are a few things you need to keep in mind when you ask about an offset account:

- It usually costs something to have an offset account. Some lenders include it in their annual package fee. Some lenders charge a monthly fee.

- Only a few lenders allow an offset account to be linked to a fixed rate loan. The fixed rate loan interest rates which allow offset account usually have a higher interest rate than fixed rates which don’t allow offset accounts to be linked to them.

- You usually will have an ATM card linked to your offset account. If your offset account gets big in size, you might not what to see that amount at the ATM. In this case, you might want to move the money in the offset account into the home loan.

- It’s possible to have multiple offset accounts but only under certain circumstances, which we explain further in the linked article.

- You might not actually need an offset account. If the costs of owning an offset account outweigh the savings, you probably don’t need one. You might want a more basic home loan product which might not have the extra fees.

It’s important to know what it takes to qualify for these types of loan features, and especially the fundamentals like credit scores and how they work, so be sure to read about this and more.